The total number of supermarkets offering EV charge points rose by 59% last year – from 1,015 stores with charging facilities in 2022 to 1,616 in 2023. This equates to 13% of all 12,839 UK supermarkets, including those that don’t have parking facilities.2

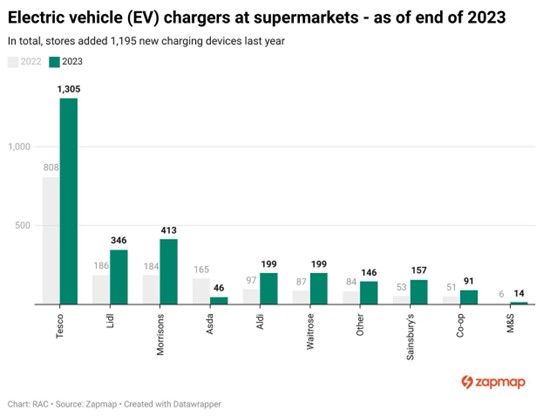

Charger installations also increased by two-thirds (69%) with stores adding 1,195 new charging devices last year. This brought the total number up from 1,721 in January 2022 to 2,916 by the end of 2023.

Within this total, 1,107 units installed were rapid or ultra-rapid, marking a huge increase of 145% from the 451 rapid chargers installed in 2022. Fortunately for electric car drivers, this means that over half (55%) of all supermarket EV locations now offer higher-powered charging capabilities.

By the end of last year, 10% of all rapid and ultra-rapid chargers in the UK were based at supermarket locations – 1,107 units out of 10,967 across the country.4

In the supermarket charging league, Sainsbury’s has seen the biggest year-on-year growth thanks to the launch of its ultra-rapid network Smart Charge. After installing just 53 units in 2022, the retailer nearly tripled its total device numbers in 2023 by adding 104 new chargers to its stores. Sainsbury’s had the highest average number of rapid chargers per location, at four units per store across the 22 shops that provided high-powered charging.

Meanwhile, Tesco is still leading the way as the biggest overall supermarket charging network. With 1,305 devices now in place across 4,859 shops, the retailer added 497 chargers to its stores last year. Consequently, Tesco has nearly 900 more devices than its nearest EV charging rival Morrisons, which has 413 chargers.

Although the number of Tesco sites with charging facilities increased by 50% year-on-year, rising from 412 stores to 617 at the end of 2023, only 10% (132) of its 1,305 devices were rapid or ultra-rapid. Just 12% of Tesco supermarkets have the capability to charge an EV at all, due to the size of its portfolio which includes many convenience stores without parking.

Both Morrisons and Lidl take the top two consecutive spots for both the greatest proportion of chargers per estate and number of rapid chargers installed. Morrisons had 413 devices at 69% (344) of its 497 stores, 99% (342) of which had rapid devices. And this is only set to increase after ultra-rapid provider Motor Fuel Group acquired hundreds of the grocer’s forecourts in January.

Lidl also has 346 chargers at nearly a third (30%) of its 960 stores in 2023, with 91% (258) of the 285 EV locations offering rapid charging facilities.

Conversely, the data shows Asda uninstalled a large proportion of its devices after its contract ended with bp pulse, dropping by 72% from 165 in 2022 to just 46 in place through 2023. This represents a drop of 81% from the 246 devices it had installed in 2021 and leaves it with facilities at just 22 stores, only 2% of its entire estate.

The RAC has long argued that more rapid and ultra-rapid chargers are needed nationally, as high-powered units enable drivers to make journeys beyond the range of their vehicles in the most time-efficient way.

RAC EV spokesperson Simon Williams said: “Concerns about the lack of public charge points are one of the biggest reasons why drivers aren’t choosing to go electric when buying their next car, with six-in-10 telling us this. It’s very encouraging to see supermarkets doing their best to allay these fears by ramping up EV charging facilities across a greater proportion of their estates.3

“The data also shows a surge of investment in the very fastest chargers. These rapid and ultra-rapid units are the closest drivers can get to filling up with fuel because they offer the fastest charging speeds, helping to reduce queues so motorists can resume their journeys as quickly as possible.

“As the supermarkets currently dominate UK fuel sales, it makes sense for them to try to retain as much of that market as they can by catering to the needs of all EV drivers looking to recharge as quickly as possible.

“It’s also great to see them bringing rapid charging to more urban areas, as this complements the obvious and much-needed focus on motorway service areas.”

Supermarkets are one of the most popular charging locations for EV drivers across the UK, as Zapmap’s latest EV charging survey demonstrates. Although motorway services and EV charging hubs displaced supermarket car parks as the most popular UK charging locations in 2023, supermarkets remain in the top three of the most regularly used location types, with more than 35% of respondents indicating they regularly stop at supermarkets to charge, as they are part of a regular routine whereby drivers can tie charging into their weekly shop.

Melanie Shufflebotham, COO & Co-founder of the UK’s leading charge point mapping service Zapmap, said: “With around 3,000 charge points now in place at supermarkets across the UK, it’s really positive to see this sustained growth at such popular charging locations for EV drivers. Not only did the total number of supermarkets offering EV charge points rise by almost 60% last year, but we also saw significant growth in the number of those all-important rapid and ultra-rapid chargers.

“These new chargers, especially the high-powered charge points, will provide any drivers who are not able to charge at home with much-needed local options – allowing them to charge while doing the weekly shop – as well as serving drivers on longer journeys and providing facilities for a quick break or a snack. With the launch of Sainsbury’s new network Smart Charge, and MFG’s acquisition of hundreds of Morrison’s sites across the country, it's great to see this trend continuing in 2024.

"Our focus at Zapmap continues to be on providing electric car drivers with the information they need to find reliable, available charging while they're out and about. We’re looking forward to putting many more supermarket locations on the map as they are rolled out in 2024.”

In 2022, the RAC joined forces with Zapmap to be even better placed to help any EV drivers that do run out of charge, with the Zapmap app distributed to the RAC’s 1,600 patrols via all their devices. This enables them to locate the nearest suitable public charge point for RAC members to get their EV recharged and back on the road again as quickly as possible.

The RAC is leading the way in helping drivers to become ‘electric-ready’ and meeting the needs of those who already are. After launching the breakdown industry’s first engine-powered emergency charger for electric cars, its patrol vans are now equipped to give motorists even more of an EV Boost with 5kW chargers that add 10 miles of range in 30 minutes or less.

And when the vehicle can’t be fixed at the roadside, the RAC’s All-Wheels-Up recovery system can safely tow broken-down EVs with all four wheels off the ground.

Zapmap is focused on making charging simple for electric car drivers across the UK and mainland Europe, providing a market-leading app that enables users to search, plan and pay for charging all in one go.

With over 70% of chargers on Zapmap showing 24/7 live availability status, EV drivers use the app to choose from many thousands of public charge points in the UK and Europe and enjoy peace of mind on longer journeys in their electric car.

RAC sale – up to 33% off*

• Roadside cover from £5.29 a month†

• We get to most breakdowns in 60 mins or less

• Our patrols fix 4/5 breakdowns on the spot

1 Data taken from the Zapmap database of public charging points analysed December 2022 – December 2023

2 Data taken from supermarket websites including those without parking facilities:

- Aldi (1,001)

- Asda (1,028)

- Co-op (2,501)

- Lidl (960)

- M&S (1,064)

- Morrisons (497)

- Sainsbury’s (600)

- Tesco (4,859)

- Waitrose (329)

3 The RAC’s Report on Motoring, section 4.2, Electric car growth stalls, page 33

4 Zapmap EV Charging Statistics 2024